The report "Anti-Counterfeit Packaging Market by Technology (Mass Encoding, RFID, Hologram, Tamper Evidence, Forensic Markers), End-use Industry (Food & Beverage, Pharmaceutical, Personal Care, Apparel & Footwear, Luxury Goods), & Region - Global Forecast to 2029", size for anti-counterfeit packaging reached USD 179.4 billion in 2024 and is projected to reach USD 326.3 billion by 2029, with a CAGR of 12.7% during the forecast period.

The need for anti-counterfeit packaging has significantly increased in response to the rise in counterfeit products, posing significant risks to consumers. Anti-counterfeit packaging utilizes a range of advanced technologies to combat counterfeiting and tampering, ensuring product safety and safeguarding consumers against fraudulent items. It plays a crucial role in building trust and loyalty among customers.

Its application spans various industries, including pharmaceuticals, food & beverage, electronics, automotive, cosmetics, apparel, and luxury goods. These industries leverage diverse anticounterfeit packaging technologies such as holograms, QR codes, RFID tags, tamper-evident seals, and blockchain-based tracking to protect their products and ensure consumer safety.

Mass encoding holds the largest share in the anti-counterfeit packaging market.

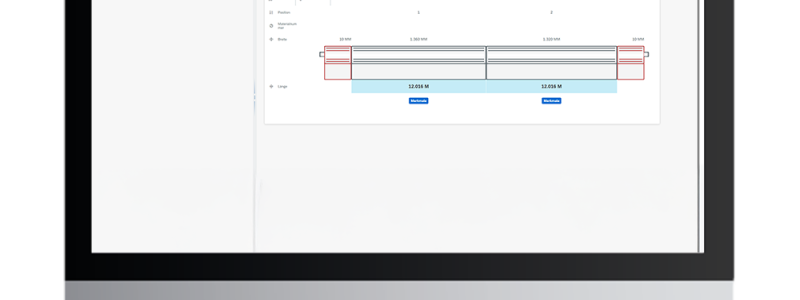

Mass encoding technology is a highly prevalent method used in anti-counterfeit packaging. This advanced technology greatly improves the security of product packaging by incorporating distinctive markers into each product's packaging. These markers come in the form of QR codes, barcodes, serial numbers, or digital watermarks. Through the implementation of this technology, each product is assigned a unique code, allowing for easy tracking and authentication. It facilitates the collection of valuable data, helping the supply chain collect relevant data. When combined with digital technologies, it further amplifies the safety measures associated with the product.

The pharmaceutical end-use industry has the largest CAGR in anti-counterfeiting packaging market.

The pharmaceutical industry relies heavily on anti-counterfeit packaging to prevent the distribution of counterfeit or fraudulent medications, a pervasive issue worldwide. The fake drugs selling pose a significant risk to consumers, potentially jeopardizing their well-being. In response to this threat, the pharmaceutical sector has widely embraced the use of anti-counterfeit packaging for medication. Governments have implemented mandatory measures, along with stringent regulations, to uphold product quality and ensure proper packaging. Pharmaceutical items are now equipped with tamper-evident features, unique identifiers, holographic labels, and RFID tags, often incorporating macro or nano text to further support security.

North America is the largest market for anti-counterfeit packaging.

The North American region is leading the global market for anti-counterfeit packaging, driven by a growing awareness among consumers regarding product safety. Customers in this region are increasingly knowledgeable about the safety of the products they consume, and they place significant importance on packaging that ensures authenticity. The presence of many pharmaceutical, consumer goods, and food manufacturers in this region is contributing to the high demand for anti-counterfeit packaging. Companies are placing strong emphasis on the use of such packaging to safeguard their brands and products. Government authorities are implementing policies to regulate and promote the use of anti-counterfeit packaging, aiming to protect consumers from the risks associated with counterfeit products.

Key Players

Avery Dennison Corporation (US), CCL Industries Inc (US), 3M (US), Sato Holdings Corporation (Japan), and Zebra Technologies Corporation (US) are the key players operating in the anti-counterfeit packaging market. Expansions, acquisitions, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the anti-counterfeit packaging market.