Technavio has announced its latest market research report titled paper and paperboard container and packaging market in APAC 2024-2028.

The Paper and Paperboard Container and Packaging Market in APAC size is estimated to grow by USD 21.3 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 4.2% during the forecast period.

Increased adoption of retail-ready packaging is driving market growth, with a trend towards use of QR code with packaging. However, limited durability of paper bags poses a challenge.

Market driver

QR codes offer a practical marketing solution for paper and paperboard containers and packaging in APAC. By placing a QR code on these containers and packaging, enterprises can provide consumers with quick access to additional product information. In primary packaging, QR codes can supplement labels with details on product origin, production methods, and usage instructions. For secondary packaging, QR codes can be used to promote the goods inside and offer tutorials on proper usage. The versatility of QR codes in enhancing the customer experience will boost the demand for paper and paperboard containers and packaging, contributing to revenue growth in the APAC market.

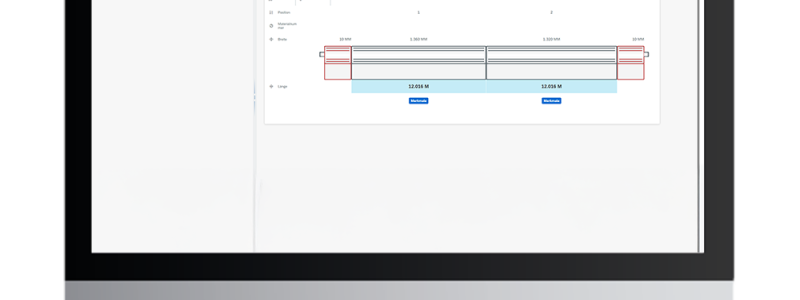

The APAC paper and paperboard container and packaging market is witnessing significant trends in the use of sustainable materials like paper and paperboard. Paper packaging is gaining popularity over polymers and plastics due to its eco-friendliness and lower carbon footprint. Folded carton packaging, a type of paper-based packaging, is a popular choice for fresh food items as it ensures product freshness. Sustainable materials such as biodegradable and recycled-grade packaging are in demand, with cellulose fibres derived from pulp being a key raw material. Innovation in packaging is a major trend, with lightweight and recyclable paper and paperboard containers being preferred for e-commerce and online food delivery. Corrugated packaging and rigid packaging are popular choices for primary packaging, while flexible packaging is used for secondary packaging. Printing technology advancements enable customized branding and design on paper and paperboard containers. The market is shifting towards renewable and recyclable materials to reduce deforestation and promote healthier food options.

Market challenges

The APAC paper and paperboard container and packaging market is experiencing growth due to the increasing demand for eco-friendly alternatives to plastic containers and bags. However, the use of paper bags in the food and beverage industry poses challenges. In 2023, the ban on single-use plastic bags in many APAC countries has led to a rise in paper bag usage. However, paper bags' durability is a concern, particularly for enterprises handling food items. Paper bags are not suitable for carrying heavy food items or packaging liquid food, leading to potential food wastage and spillage. For instance, in Pune, India, paper bags accounted for over 13% of food wastage in restaurants in June 2022. Food services providers find it challenging to use paper bags for takeaway services due to the risk of liquid food spillage and damage to paper containers. As a result, the durability of paper bags, especially in the food and beverage sector, remains a significant barrier to market growth in APAC.

The Paper and Paperboard Container and Packaging market in APAC faces challenges in the form of increasing imports and exports, requiring efficient supply chain and inventory management. Writing paper and packaging innovations, such as folding cartons and RFID technology, are essential for fast-moving consumer goods like frozen meals and eco-friendly packaging. Sustainability is a key trend, with a focus on circular economy, recycled fibers, and sustainable green packaging. Kraft Collection, paper bags, and recycled paper bags are popular choices. However, challenges include non-biodegradable materials, energy consumption, and greenhouse gas emissions. The food and beverage sector, including beverages in Tetra packs, demands environmental friendly packaging solutions. Online shopping and e-retailing channels require convenient packaging for small pack sizes. RD activities aim to reduce CO2 emissions and improve health benefits. Processed packed goods and flexible plastic packaging also present challenges. Environmental standards and recycling are crucial for reducing waste and minimizing the use of virgin materials.

Key market players include Amcor Plc, C and H Paperbox Thailand Co. Ltd., Continental Packaging Thailand Co. Ltd., Graphic Packaging Holding Co., Hong Thai Packaging Co. Ltd., Huhtamaki Oyj, International Paper Co., Mondi Plc, Nine Dragons Paper Holdings Ltd., Nippon Paper Industries Co. Ltd., Oji Holdings Corp., Rengo Co. Ltd., Sarnti Packaging Co. Ltd., SCG Packaging, Shandong Sun Holdings Group, Tetra Pak International SA, Toyo Seikan Group Holdings Ltd., WestRock Co., Xiamen Hexing Packaging and Printing Co. Ltd., and Zijiang Holdings.

Source: Technavio